Sanctions Screening Solution

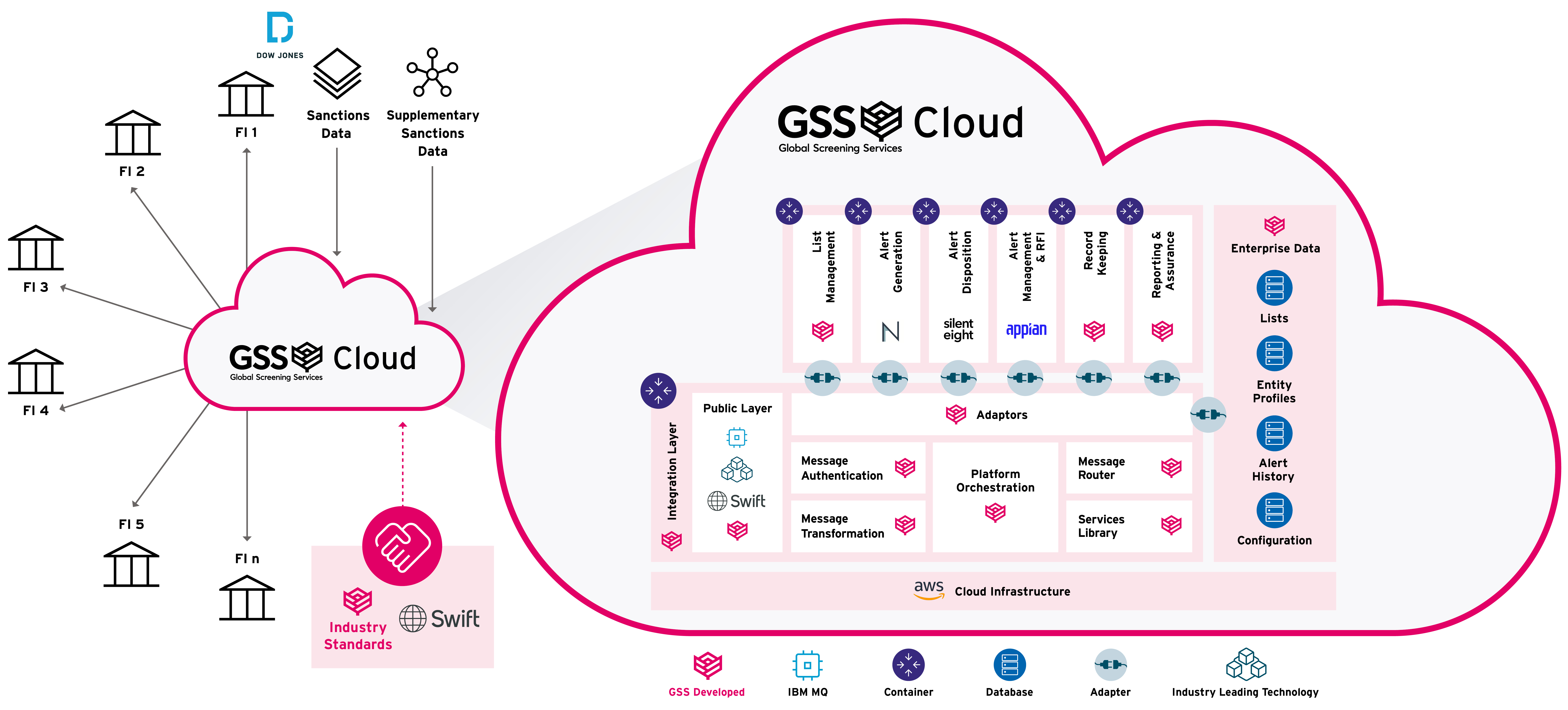

GSS is an industry-leading sanctions screening platform that helps financial institutions comply with global sanctions regulations. GSS is based on industry-defined standards and uses cloud-native technology to provide a more effective and efficient sanctions screening solution.

Financial institutions provide data to GSS, such as transaction data, and GSS returns an alert if there is a match against a sanctions list. Financial institutions remain fully responsible for sanctions compliance, but GSS can help to streamline the screening process. GSS also allows financial institutions to configure the platform to meet their specific risk appetite.

GSS delivers an end-to-end sanctions screening solution

We collaborate with industry-leading partners to deliver a fast, efficient and seamlessly integrated service.

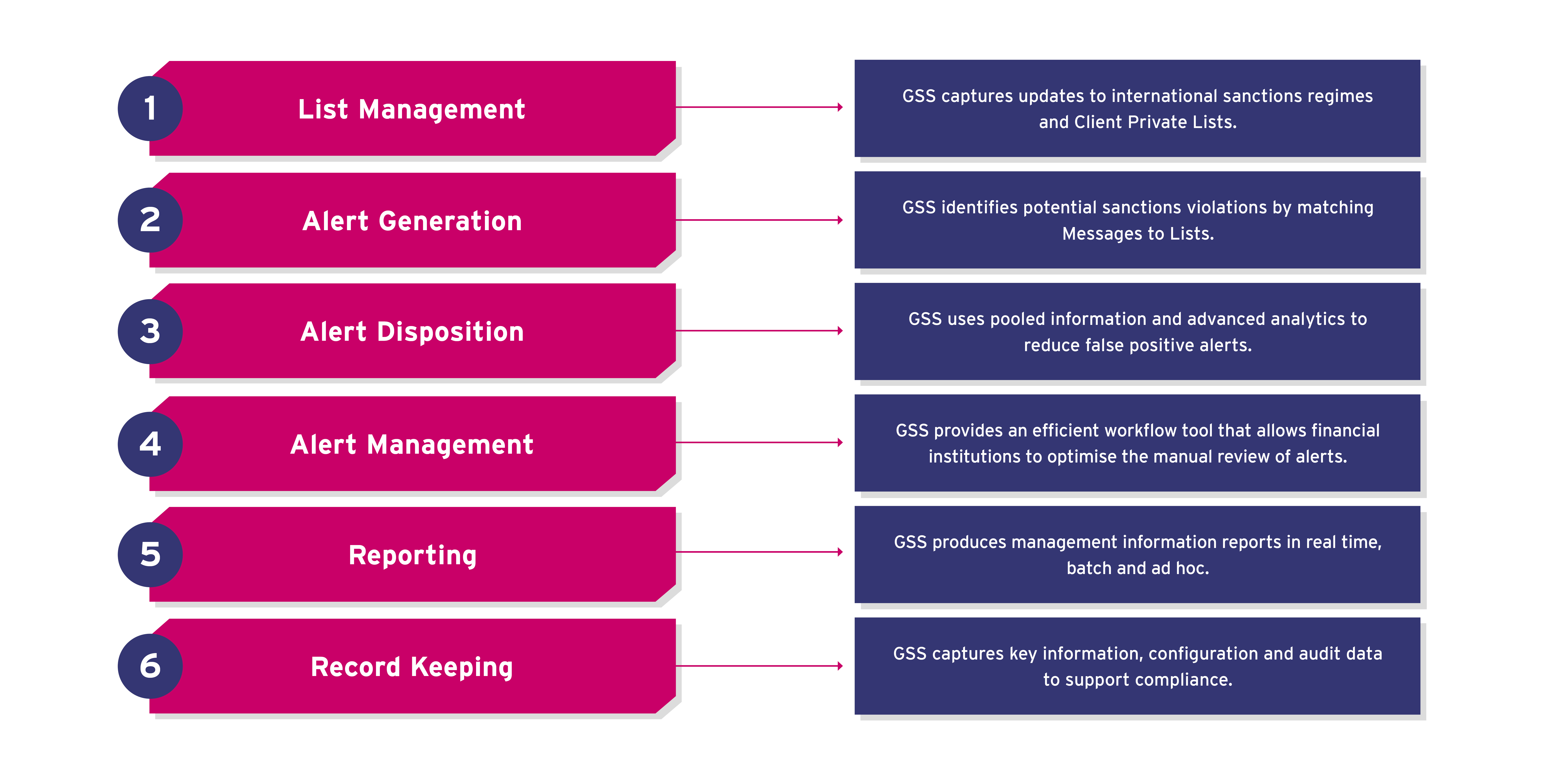

GSS’ sanctions screening capabilities include:

- List management: We acquire public lists and our client’s private lists for the purpose of being used for screening.

- Alert generation: We identify potential sanctions matches.

- Alert disposition: We identify potential false positives sanctions matches.

- Alert management: We allow a client’s alert investigation team to manually review alerts.

- Reporting: We provide management information reports.

- Record keeping: We record key information and audit data and provide it to our clients.

The result is a more effective and efficient screening product allowing financial institutions to leverage cloud-native technologies and automation for one of their most important compliance processes

GSS Standards: The Industry Standard for Sanctions Screening

Sanctions screening is a complex and ever-changing challenge for financial institutions. To comply with global sanctions regulations, institutions must screen their customers, transactions, and other data against a variety of sanctions lists. However, there has been a lack of common standards and approaches to sanctions screening, which has led to inefficiencies, inconsistencies, and increased costs. As a result, institutions have had to work out how they can screen individually.

Repeatedly developing individual solutions for transaction screening leads to inconsistencies and inefficiencies. GSS brings financial institutions together to define common standards and solve problems collaboratively, leveraging collective expertise to create best-in-class solutions, from the industry, for the industry.

The GSS Standards are a set of industry-defined standards for sanctions screening, which have been developed by a consortium of over 30 global financial institutions, including Swift and The Wolfsberg Group. The GSS Standards cover all aspects of sanctions screening, including:

- List Management

- Alert Generation

- Alert Disposition

- Alert Management

- Reporting

- Record Keeping

These standards are designed to help financial institutions improve the efficiency, effectiveness, and consistency of their sanctions screening programs.

By adopting the GSS Standards, financial institutions can benefit from:

Reduced friction in global payments: GSS Standards introduce consistency, helping to reduce friction in the global payments industry by harmonizing sanctions screening practices across different institutions. This can lead to faster and more efficient cross-border payments.

Improved regulatory compliance: GSS Standards are aligned with the latest regulatory guidance and industry best practice on sanctions screening. By adopting GSS Standards, financial institutions can demonstrate their commitment to regulatory compliance.

Reduced costs: GSS Standards can help financial institutions to reduce the cost of sanctions screening by improving the efficiency and effectiveness of their programs.

Improved customer experience: GSS Standards can help financial institutions to improve the customer experience by reducing the number of false positives and delays in processing transactions.