In 2010, the fastest way to move money from London to New York on the same day was to catch a flight from Heathrow to JFK and deliver it yourself.

Fast forward a little over a decade later and the average time to complete a cross-border payment is now under two hours. Fast, but not fast enough. The industry’s goal is to move towards instant payments via all cross-border payment corridors, similar to the domestic payments that settle in less than 10 seconds. Speeding up cross-border payments is vital, as is providing access to all but not at any cost. However, sacrificing high compliance standards, which would reduce friction, especially for screening payments for sanctions linkages, is unacceptable. Another way must be found.

The journey towards achieving frictionless payments is underway. The Financial Stability Board’s (FSB) end of 2027 targets to improve cross-border payments are now just over four years away, but they still feel too ambitious. Still, a roadmap and actions designed to speed that journey along are coming together, and if we could find a way to address friction in sanctions screening, which would constitute a significant breakthrough and help quicken the pace. The key to success lies in re-imagining sanctions screening to reduce the inherent friction in the current system and, through collaboration, reduce the complexity of sanctions screening for all by agreeing on standards and applying these consistently across the industry.

Meeting the growing needs of cross-border payments

The growth in cross-border payments is expected to rise by at least 6% in the coming years, with B2B payments dominating these flows, followed by C2B, B2C and C2C. Current estimates put the value of these payments in the region of US$30-40 trillion for 2021/2022.

The costs of cross-border payments can be offset against the value of the transaction for big businesses, but the processing time remains a growing concern. Meanwhile, for consumers, both time and cost are becoming a factor leading to financial exclusion, especially for foreign workers making overseas remittances. According to the Bank of England’s guidelines, “in some instances, a cross-border payment can take several days and can cost up to ten times more than a domestic payment”.

In 2021, HSBC echoed the industry’s concerns, noting a “demand for speedy friction-free payments to meet evolving business needs” with “payments becoming a by-product of business operations rather than an operation in themselves”. It’s a long-standing concern, with 30% of US businesses alongside payment fraud, data security, knowledge of foreign exchange (FX) rates and fees, and knowledge of transaction and settlement.

Time taken to settle transactions:

- McKinsey found that up to 24% of cross-border payments only settle the next day.

- J.P. Morgan highlights, “it is not uncommon for payments to take 2-3 days to reach the end beneficiary.”

- CPMI note, “it can still take as long as ten days to transfer money to different jurisdictions. A payment from the UK to some countries must go through four currencies and as many as five banks.”

SWIFT adds that the main reasons for these delays are “currency controls and regulatory requirements and market infrastructures at the beneficiary banks.”

Transparency and Speed are vital

While instant payments are considered ideal, more certainty around payment arrival and tracking options is needed. Therefore, improving predictability is critical.

According to recent data from SWIFT, “the [mean] average payment processing time is 8 hours and 36 minutes, while the median is only 1 hour and 38 minutes” across 57,000 end-to-end payment routes. However, on less busy routes, some payments can take days to settle.

Overcoming systemic challenges

The FSB, the BIS (Bank of International Settlements), CPMI (Committee on Payments and Market Infrastructures) and FATF (Financial Action Task Force), alongside domestic Central Banks, SWIFT, Commercial Banks, and other market infrastructure players, are working to speed up these payments, making them cheaper and more accessible to all.

Cross-border payments are more complex than domestic payments. With no end-to-end system, they typically have higher fees and longer processing times involving multiple intermediaries to perform currency conversion and settlement of funds. Adding to this uncertainty, fees are assessed as a payment moves through intermediaries and are not always evident until the net amount is received. For example, this creates issues for businesses executing payroll or consumers managing second homes.

Improving cross-border payments is seen as a priority for the G20 while navigating three systemic challenges:

- Compliance with anti-money laundering and anti-terrorism financing regulations.

- Cost and complexity of complying with regulatory standards across global jurisdictions eroding access to services.

- Financial institutions face liquidity challenges with trillions of dollars of capital funds in pre-funded transactional accounts.

Friction from Sanctions

All Banks involved in the payment chain, from the ordering customer’s bank through intermediary correspondent banks to the receiving bank, are required to carry out sanction’s compliance checks before a payment can be credited to an account.

An essential preventative control, it is typically effective in keeping sanctioned persons from using their own details to transact cross border but less so in identifying true matches. However, checks are burdensome and the overall process highly inefficient. This is compounded as payments are made through a chain of banks who all must conduct the same screening checks, often resulting in the same type of checks, usually made up of false positives. With each bank required to screen cross-border message data against prescribed lists, efforts are inevitably duplicated.

A 270% increase in the number of sanctioned people and entities since 2017 (now 52,000 across seven countries and regions), has also increased the number of false-positive alerts generated. The conflict in Ukraine has seen thousands of additional names added to major lists. In turn, the increased traffic volume has increased the economic burden of sanctions screening for the industry and the friction affecting commerce and remittances.

With an estimated 20-40 billion annual cross-border transactions growing at up to 6% p.a. worth an estimated $30-40 trillion, friction from sanctions is not trivial and is increasing. Global alert investigations are having to ramp up materially, and a $2 billion tech spend for sanctions compliance alone has been estimated. Screening is time and cost-sensitive, yet over 99% of alerts investigated have no true match. GSS estimates a true match rate to be approximately 0.11-0.25% at best. Additionally, the tech approach is highly fragmented, largely on-premises, typically using legacy methods and siloed within FIs.

The time has come for the industry to design a better way, and to tackle head-on the unintended and severe consequences sanctions screening generates.

The solution

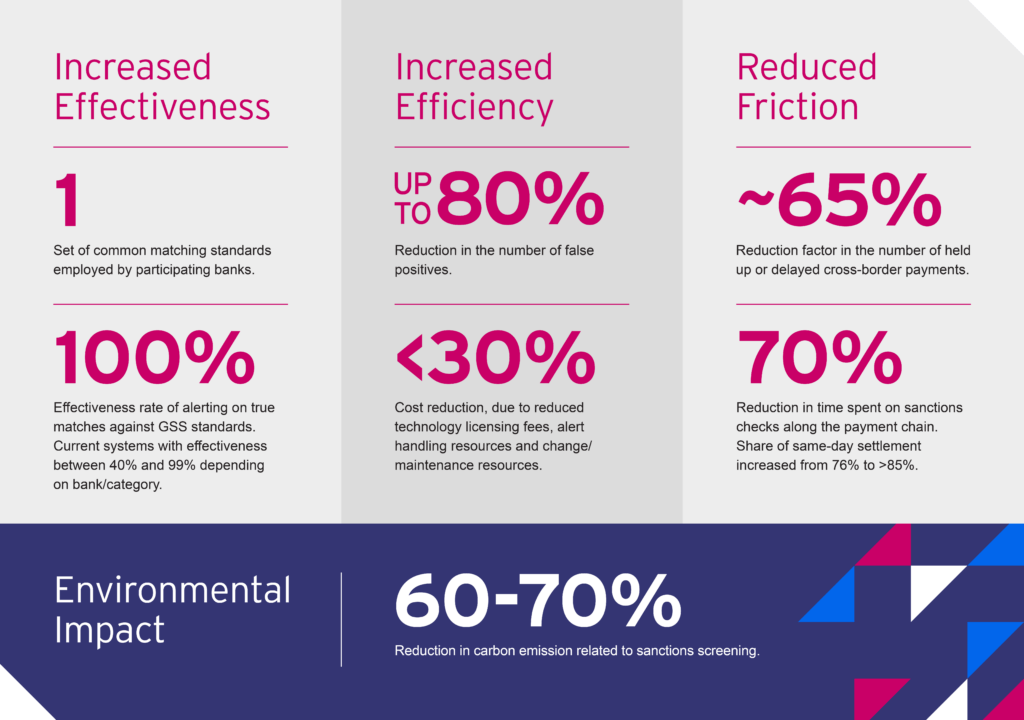

GSS was founded in 2021 to provide for this better way, with industry experts convinced there are substantial benefits to be gained from agreeing common sanctions screening standards, sharing information, delivering solutions via a common trusted platform, and adopting the best new available technology.

Starting with sanctions screening, GSS re-imagines how fighting financial crime is managed by partnering with leading financial institutions and trusted industry partners. Developed in collaboration with more than twenty banks, in partnership with SWIFT and cognisant of the nature and scope of applicable regulation, financial services and data protection, the solution goes live in 2023.

How GSS works

GSS works by digesting financial institutions (FIs) transaction data directly into its cloud ecosystem via a proprietary integration layer. Once the transaction data is uploaded to the secure GSS cloud environment, GSS takes the various submitted data formats and screens the transaction data against selected public and private sanctions lists, using a common matching standard developed and agreed with the industry.

Data is checked against these lists and user-specific risk configurations throughout the process. With the introduction of ISO20022 message data standards, the opportunity for enhancing the screening processes even further through more targeted screening is possible.

Creating Request for Information (RFI) standards and corridors for involved banks to exchange information via provided rails under agreed conditions will also enhance the process.

The result is a more effective and efficient sanctions screening product that allows users to leverage cloud-native technologies and automation for one of their most essential compliance processes.

The GSS difference

A path forward

This innovative approach, delivered through a platform, is available to all FIs. The GSS solution will help overcome the inconsistent application of standards, also hindered by the limitations of ageing tech and inefficient communications channels. It will attack friction in terms of costs and speed generated by sanctions screening conducted individually and ultimately translate positively into helping achieve several FSB targets on cross-border payments.

This is an edited extract from ” The Future of Cross Border Payments” by John Cusack published 06/01/2023 here